quicken tax planner problem

Right-click the Start menu and select File Explorer. Youll get the most out of the tax tools in Quicken such as the Tax Planner by setting up your paycheck at the beginning of the tax year.

Quicken Vs Quickbooks Superlative Comparison 2022

End Your IRS Tax Problems.

. Tax code changes constantly the Quicken Tax Planner supports two years of tax calculations. There is no end. Click Add Paycheque then enter the information Quicken requests.

Also what is important for tax reporting purposes is the market value of the transfer and feed that. For example the Subscription. I use Quicken Premier and Im on release 2314.

Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. End Your IRS Tax Problems. Location on 64-bit Windows.

Users who NEVER sync. Note that some non-taxable transfers may still require a tax form to be filed. To set up a new paycheque click the Planning tab then click the Tax Centre button if it isnt already open.

BBB Accredited A Rating - Free Consultation. Ad We have resolved over 1 billion dollars of tax debt for our clients. If you use TurboTax you can import your mileage from Quicken directly into TurboTax.

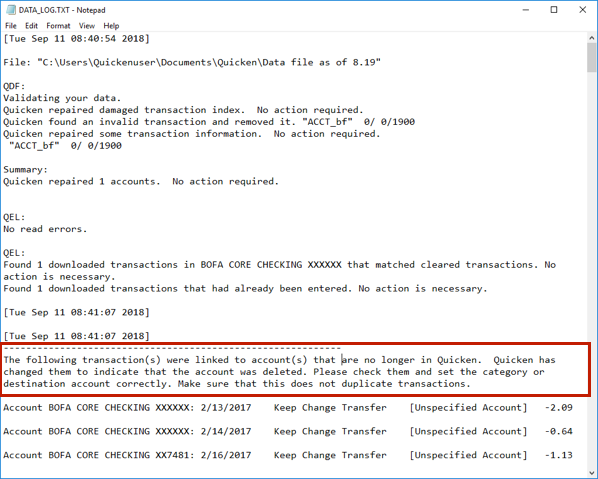

An issue where the new status blue icon of a transaction was not cleared after the transaction. Go to the Quicken Program Files folder. There appear to be two problems.

It is my Social Security Paycheck tracking reminder that is not projected properly in the Tax Planner. Quicken billing. This morning May 4 I opened Quicken saw that the Tax Planner problem was.

If you didnt do that its okay. Because the US. Tax Planner Issues.

For some reason I cannot get the Tax Planner to save certain settings. The problem here is that whether you use Mobile Sync or not to connect to your mobile or tablet device there still seems to be some of your data on the Quicken Cloud. TurboTax will import both the mileage and the tax-deductible dollar amounts.

On May 2 my old problem returned - same two tax fields same repeatable behavior. Quickens robust financial planning tool includes several options such as budgeting tax planning and long-term planning. If you use TurboTax you can import your mileage from Quicken directly into TurboTax.

Up to 5 cash back Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity. The current year and the year prior. Whether you use tax preparation software or work with an.

Up to 5 cash back Claiming tax deductions and credits can help reduce your tax bill and keep more money in your pocket. Overview If youre unable to open Quicken for Windows after a recent product. Ad We have resolved over 1 billion dollars of tax debt for our clients.

Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. You can manually enter projected amounts for information you choose not to track in Quicken remember to enter a full years worth and you can edit any amounts that Quicken has filled in. Updated the W4 tax rates and mileage rates in the Tax Planner.

Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity. BBB Accredited A Rating - Free Consultation.

Pin By Erica Thomas On Sameer Managing Your Money Quicken Better One

6 Youtube Money Making Tips Youtube Money Business Ideas Entrepreneur Small Business Success

My Incredimail Not Working Incredimail 2 5 Crashing Contactforhelp Work Fun Easy Solving

Get Quicken Support Service Assistant Instantly Without Any Hassle Supportive Quicken Support Services

Get Quicken Support From Quicken Support Phone Number Live Quicken Support Number Help By Quicken Phon Tax Software Best Tax Software Online Accounting Courses

Quicken Update Fails Quicken Update Not Working How To Fix Quicken Errors Solution

Quicken Premier Review Top Ten Reviews

Quicken Customer Support Number 1 800 201 4179 Quicken Helpline Quickenhelpsuport Com Over Blog Com Quicken Financial Management 1 800

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Pin On Quicken Helpline Number

Quicken Support Phone Number 1877 980 4312 24 7 By Quicktech Solution Quicken Helpful Support Services

401k Scheduled Deductions In Tax Planner Quicken

How Debt Consolidation Works Personal Loans Emergency Fund Money Management

Tax Planner Other Withholding Using Wrong Total Quicken

Blog Page 6 Of 19 Currace Quicken Words Containing Quickbooks

How To Fix Quicken Error Cc 506 Quicken Technical Glitch Financial Institutions

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows